THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Part of growing as a person and being the best version of yourself is your finances.

You can be the kindest soul on the planet, but if your finances are in shambles, you are going to be stressed at the very least.

And chances are you will be unhappy too, because you won’t be able to live the life you dream of.

But that all ends today.

Today, you are going to learn the 11 best financial tips to get your life back on track.

After you complete these 11 tips, you will improve your finances, which in turn will create more happiness and less stress in your life.

And it very well may lead to more opportunities in your life as well.

You have nothing to lose and everything to gain.

So let’s get started with the best financial tips to get your life on track.

The 11 Financial Tips To Get Your Life On Track

To make things simple, I’ve broken down the steps to financial success into 11 financial tips and tricks.

By following these guidelines, you will see your finances improve over time.

And as your finances improve, any money related stress you experience will fade away.

#1. Pay Yourself First

This is the first step because it is the most important.

You need to get into the habit of paying yourself first.

Without it, you will never get ahead financially.

Here is why.

Most people have a plan to pay all their bills each month and then save what is left over.

This sounds like a good plan, but the problem is we are human.

During the month, we see things we want to buy.

After we pay our bills and see there is still money left, we buy the things we saw and skip saving money.

This process repeats itself most every month.

Fast forward a year and you’ve saved nothing.

Here is how to fix this.

Pay yourself first.

Before you pay any bills, save money.

I don’t care if it is $100 or $20 or even $5. Just save something.

You know how tight money is, so pick an amount that makes sense for you.

Then set up an automatic transfer from your checking account to your savings account on the first of every month.

This is easy to do when you log into your bank online. If you have trouble, call your bank and they will walk you through it.

Then sit back and let your savings grow.

Actually, before you sit back, set up a reminder on your phone for 1 year from now.

You want to remind yourself to go back into the transfer you set up and increase it by $10.

Now sit back and let your savings grow.

#2. Live Within Your Means

Advertisers are great at tempting us to buy whatever they are selling, regardless if we need it or not.

Because of this, many of us live beyond our means.

Put another way, we spend more than we earn.

This is a guaranteed way to never have any money and live with a huge weight of stress on your shoulders.

Here is how you fix this.

Understand how much money you make and how much you spend in a given month.

This doesn’t have to be exact, though that would be ideal.

For now, just get a good estimate.

For example, you know that you make $2,000 a month and after all your bills are paid you have $200 left over.

Keep this in mind when you start buying things. You can only spend $200 a month.

This sounds difficult and it is if you don’t understand what you value in life.

Luckily, I am going to teach you this now.

#3. Understand What You Value

What excites you in life?

Take a few minutes to think about it.

Once you have an idea in your head, think about how you spend money.

Do the two line up?

For most of us, the answer is no.

We buy whatever was see because the advertisements make us think we need it or will improve our life or make us happier.

The truth is, only you know what will make you happy.

For example, let’s say you value spending time with friends and family members.

But instead of spending money on trips to see them or food for monthly get-togethers, you lease a brand new car, or buy the newest phone the minute it comes out.

Sure it feels good to have these things in the moment, but that feeling quickly fades.

Then you feel meh about life again.

If instead you pass on the new phone and spend money on food for monthly get-togethers, you will feel much happier and save money at the same time.

I challenge you to try this and see how well it works.

#4. Destroy Any High Interest Debt

Being in debt is a surefire way to never get ahead in life.

Instead of putting money into savings or investing it, you are giving it to someone else.

Here is another way of looking at it.

When you go to work to earn money, you aren’t working to pay yourself to enjoy life. You are working to pay someone else.

How crazy is that?

I understand there is some debt that is necessary, like a mortgage.

But credit card debt and auto loans are ones that you can avoid.

So if you have credit card debt, make it a point to start paying it off.

I recommend the debt snowball.

This is because it keeps you excited and motivated during the long journey to get out of debt.

Here is how it works.

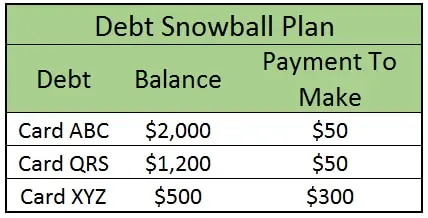

- First organize your debt from smallest balance to highest.

- Next, figure out how much you can put towards your debt each month.

- Third, pay the minimum balance on all your debt except for the smallest balance.

- Finally, put everything else towards the smallest debt.

For example, let’s say you can pay $400 towards debt each month. You have 3 credit cards and each one has a minimum payment of $50 a month.

The balances are as follows:

- ABC: $2,000

- XYZ: $500

- QRS: $1,200

You will pay $50 each towards ABC and QRS. The remaining $300 will go towards XYZ.

Do this until you pay off XYZ.

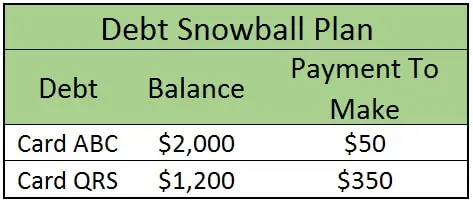

Now repeat the process for the two remaining cards.

Here $50 will go towards ABC and the other $350 will go towards QRS.

Once that card is paid off, you can put the entire $400 towards ABC.

After that, take the $400 and split it. Put half into savings and the other half pay extra on your mortgage.

#5. Invest Today

A critical part of improving your finances is to grow your savings.

With interest rates at all time lows, you need to invest in the stock market more than ever.

But it is scary.

That is unless you understand how it works.

And trust me when I tell you it isn’t hard to figure it out.

I’ve worked in the field for 15 years. I’ve been investing for over 20 years.

My investments have steadily grown over the years.

And I’m not investing in anything crazy.

I have a few index mutual funds that I invest in on a regular basis.

I invest every month and don’t worry what the market is doing.

Are there months and years where I lose money? Of course. That is part of investing.

But I make a lot more money.

In fact, since 1928, the stock market has gone up 74% of the years.

In other words, odds are you will make money.

Just pick a few low cost mutual funds or exchange traded funds and invest in them every month.

I recommend Acorns.

They make investing simple.

Click the button below to get started and they will give you $5!

This is similar to paying yourself first, only this time you are putting your money into the stock market and not a savings account.

I wrote an article that walks you through the process of becoming a successful investor.

#6. Choose The Right Career

Another important factor in your financial life is choosing the right career.

This isn’t to say you need to become a doctor or a lawyer in order to be financially successful.

While it does help to have a career that pays you extremely well, it is not required.

What you need to do is pick a career that makes you happiest.

The reason for this is because you are going to spend much of your adult life working, so you better do something that you enjoy.

Otherwise, there is the potential for a lot negativity in your life.

This includes:

- Depression

- Poor health

- Divorce

- Lost relationships

- Lack of motivation

The list goes on and on.

When you work in a job you hate, it ends up taking control of every other aspect of your life.

When I was working a job I hated, I began to dread Sundays, knowing I had to go back to work.

I became depressed, stopped hanging out with friends, started to eat poorly, and more.

It was a quick and ugly spiral and all changed when I found a job I enjoyed.

So if you are working in a job you dislike, make it a priority to find something else.

#7. Avoid Lifestyle Creep

Next on the list of financial tips is to avoid lifestyle creep.

This is a fancy way of saying you spend more money as your income rises.

When you are first starting out your career, you have a decent car and an apartment.

As your income increases, you buy a nicer car and house.

When you continue to get raises, you buy more expensive things.

All of this keeps you in a trap of never getting ahead.

While you are earning more money, you are spending just as much.

In order to get ahead, you need to keep the gap between the two as wide as possible.

This means enjoying what you have and when you do get a raise, to save the difference.

This isn’t to say you can never have anything nice, but be smart about it and you will thank yourself in the years to come.

#8. Increase Your Income

If you are in a lot of debt or are barely able to survive financially every month, looking for additional income is a smart move.

In fact, earning more income regardless of how tight your finances are is a smart move.

This is because more income can open a lot of doors.

For starters, you can pay off more of your debt if you have any.

Or if money is tight every month, additional income can provide breathing room and reduce stress.

And even if you don’t need the extra income, here is how it helps.

You can save more money every month.

And as you save more money, it can compound and grow faster.

Have you heard of the magical penny? It’s a great tale of how powerful compound interest is.

I was in a decent financial position when I started my website.

The money I made covered the bills for running it and any income left over went into a retirement account.

It wasn’t much money, but it pushed my retirement savings years ahead of where I should have been.

And as the website grew, so did the income.

When I was laid off, having this extra source of income opened many doors for me.

I was able to make it my full time job.

This is why more income is never a bad thing.

Here is a great site that will help you find ways to make some extra money on the side to help you change your life for the better.

#9. Protect Yourself And Your Money

One of the most overlooked parts of financial success is the impact insurance plays.

Insurance is a must. It allows you to transfer risk from yourself to the insurance company for an annual fee.

The last thing you want is for your house to burn down and you not have the money to rebuild.

Or worse, a spouse passes away suddenly and you have no savings to make up for the loss of income.

Make it a point to have adequate insurance coverage so that when something catastrophic happens, it doesn’t destroy you financially.

#10. Marry Smart

If insurance is one of the most overlooked aspects of your finances, marrying smart is the one the majority of people don’t consider.

Before you marry someone, make sure you talk about money in great detail.

Do they have debt? Are they a saver or spender? Do they want to live life to the fullest now or find a healthy balance between saving for tomorrow and living today?

The reason you need to know these things is because they need to align with your beliefs.

Sure a saver can marry a spender and have it work out long term, but in most cases it doesn’t.

And getting divorced will destroy your finances faster than anything.

Overnight you will lose half your wealth. And if you have to pay alimony or child support, most of your income is gone too.

The simple solution is to marry smart.

While this doesn’t guarantee you will not end up divorced, it will greatly lower the odds.

#11. Improve Yourself

Finally, we come to improving yourself, which is why you read the articles I write.

When you make a habit to improve yourself on a regular basis, you open the door to new opportunities and possibilities in life.

So begin to work on bettering yourself.

I even suggest you allow for 5-10% of your monthly income to go towards books or courses that will help you on your journey of improving your life.

When focus on these things, everything else in life will start to fall into place.

Final Thoughts

At the end of the day, getting your finances in order is critical to living your best life.

And by following the financial tips I presented, you can begin to get yours in order.

Just be sure to take things slow and not expect massive results overnight.

Like most things in life, you have to work on your finances on a regular basis and you will slowly see results.

Then in a few years you can look back and be amazed at how far you have come.

Jon Dulin is the passionate leader of Unfinished Success, a personal development website that inspires people to take control of their own lives and reach their full potential. His commitment to helping others achieve greatness shines through in everything he does. He’s an unstoppable force with lots of wisdom, creativity, and enthusiasm – all focused on helping others build a better future. Jon enjoys writing articles about productivity, goal setting, self-development, and mindset. He also uses quotes and affirmations to help motivate and inspire himself. You can learn more about him on his About page.